After the big announcement of a “sooner than expected” rates hike, the BOE is changing its mind: inflation is expected to remain low for a while

Now that’s a surprise.

Let’s take a look at the main points from the latest report of the Bank of England

- Inflation is forecast to drop to just 1.1% in the first quarter of next year. It’s not expected to go back to target for three years.

- Unemployment to fall to 5.5% by the middle of 2015.

- Growth forecasts are stronger than expected: the Bank says GDP will rise 3.4% this year, 2.7% next year and 2.6% in 2016. Analysts were expecting forecasts to be a bit more modest this time.

- But world growth is crumbling: the Bank now says it’ll be 0.25 percentage points lower this year than they expected previously, and 0.5 points lower than they thought next year.

- As a result, market expectations for the first rate hike are significantly down from where they were three months ago: investors now expect the bank’s benchmark interest rate to rise to just 1% by the start of 2016, as opposed to the 1.5% they expected before.

- Markets expected the first rate hike in February 2015 three months ago. That’s now shifted all the way to October, and the Bank seems pretty content with that.

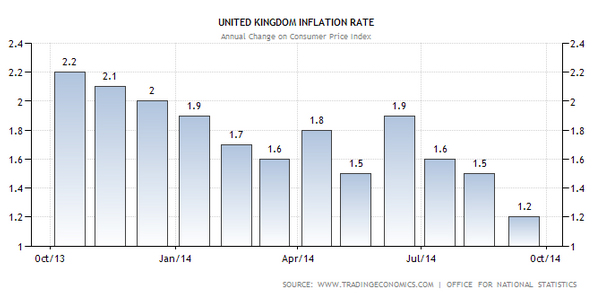

In case you need a short summary of the summary above: the BOE is not willing to raise its rates anytime soon, inflation expectations are still really low and far from the 2% target.

And here’s the current situation:

Lascia un commento per primo